Our experienced team made this ECB Slashes Interest Rates To Stimulate Eurozone Economy guide to help target audience make the right decision.

FAQ

The European Central Bank (ECB) has slashed interest rates to stimulate the Eurozone economy. This move is intended to boost economic growth and inflation by making it cheaper for businesses to borrow and invest. Here are some frequently asked questions (FAQs) about this decision:

Question 1: Why has the ECB cut interest rates?

The ECB has cut interest rates to stimulate economic growth and inflation in the Eurozone. The economy has been slowing in recent months, and inflation has been below the ECB's target of 2%. By cutting interest rates, the ECB is hoping to make it cheaper for businesses to borrow and invest, which will lead to more economic activity and higher inflation.

ECB Cuts Interest Rates Again, Lowers Eurozone Growth Forecasts - Source en.econostrum.info

Question 2: What is the impact of the interest rate cut on businesses?

The interest rate cut will have a positive impact on businesses. It will make it cheaper for businesses to borrow money, which they can then use to invest in new equipment, hire more workers, or expand their operations. This should lead to more economic growth and job creation.

Question 3: What is the impact of the interest rate cut on consumers?

The interest rate cut will have a mixed impact on consumers. On the one hand, it will make it cheaper for consumers to borrow money, which could lead to increased spending. On the other hand, it could also lead to lower interest rates on savings accounts, which could reduce consumers' income.

Question 4: What are the risks of the interest rate cut?

There are some risks associated with the interest rate cut. One risk is that it could lead to higher inflation. If inflation rises too quickly, it could erode the value of savings and make it more difficult for people to afford basic necessities. Another risk is that the interest rate cut could lead to a housing bubble. If interest rates are too low, it could make it easier for people to buy houses that they cannot afford. This could lead to a housing bubble, which could eventually burst and cause a recession.

Question 5: What is the ECB's target for inflation?

The ECB's target for inflation is 2%. This means that the ECB is aiming for inflation to be slightly above 2% in the medium term. The ECB believes that this level of inflation is necessary to support economic growth and job creation.

Question 6: What is the outlook for the Eurozone economy?

The outlook for the Eurozone economy is mixed. On the one hand, the economy is slowing and inflation is below the ECB's target. On the other hand, the ECB has taken steps to stimulate the economy, and the unemployment rate is relatively low. Overall, the outlook for the Eurozone economy is uncertain, but there are some positive signs.

For more information on this topic, please refer to the following article: ECB Slashes Interest Rates To Stimulate Eurozone Economy.

Tips for Understanding ECB Interest Rate Cuts

The European Central Bank (ECB) recently announced a reduction in interest rates in an effort to stimulate economic growth in the eurozone. This move has significant implications for businesses, consumers, and investors. Here are some tips to help you navigate the potential effects of this decision.

Tip 1: Evaluate Borrowing Options

Lower interest rates make borrowing more attractive for both businesses and consumers. If you're considering a loan, explore your options and compare interest rates from different lenders. You may be able to secure a more favorable deal due to the reduced rates.

Tip 2: Consider Investments

With lower interest rates, the return on traditional savings accounts becomes less attractive. Consider diversifying your investments by exploring higher-yield options such as stocks, bonds, or real estate. However, it's important to assess your risk tolerance and conduct thorough research before making any investment decisions.

Tip 3: Monitor Inflation

Lower interest rates can potentially increase inflation. Keep an eye on economic indicators to gauge the level of inflation and adjust your spending and investment strategies accordingly.

Tip 4: Assess Business Impact

Businesses may experience both positive and negative impacts from lower interest rates. Reduced borrowing costs can facilitate expansion and investment, while lower consumer spending could affect revenue. Business owners should carefully consider these factors when making strategic decisions.

Tip 5: Seek Professional Advice

If you're unsure about how interest rate cuts will affect your financial situation, consider seeking guidance from a financial advisor or economist. They can provide tailored advice based on your specific circumstances.

The ECB's decision to slash interest rates is a significant economic development with potential implications for individuals and businesses alike. By following these tips, you can navigate these changing circumstances and make informed financial decisions.

ECB Slashes Interest Rates To Stimulate Eurozone Economy

To bolster the Eurozone economy, the European Central Bank (ECB) has implemented a range of measures, including interest rate cuts. These key aspects explore the multifaceted implications of this decision.

In conclusion, the ECB's interest rate cuts can have a wide-ranging impact on the Eurozone economy. They aim to stimulate growth, combat deflation, and support financial stability. While the long-term implications remain uncertain, these key aspects highlight the potential consequences of this significant monetary policy decision.

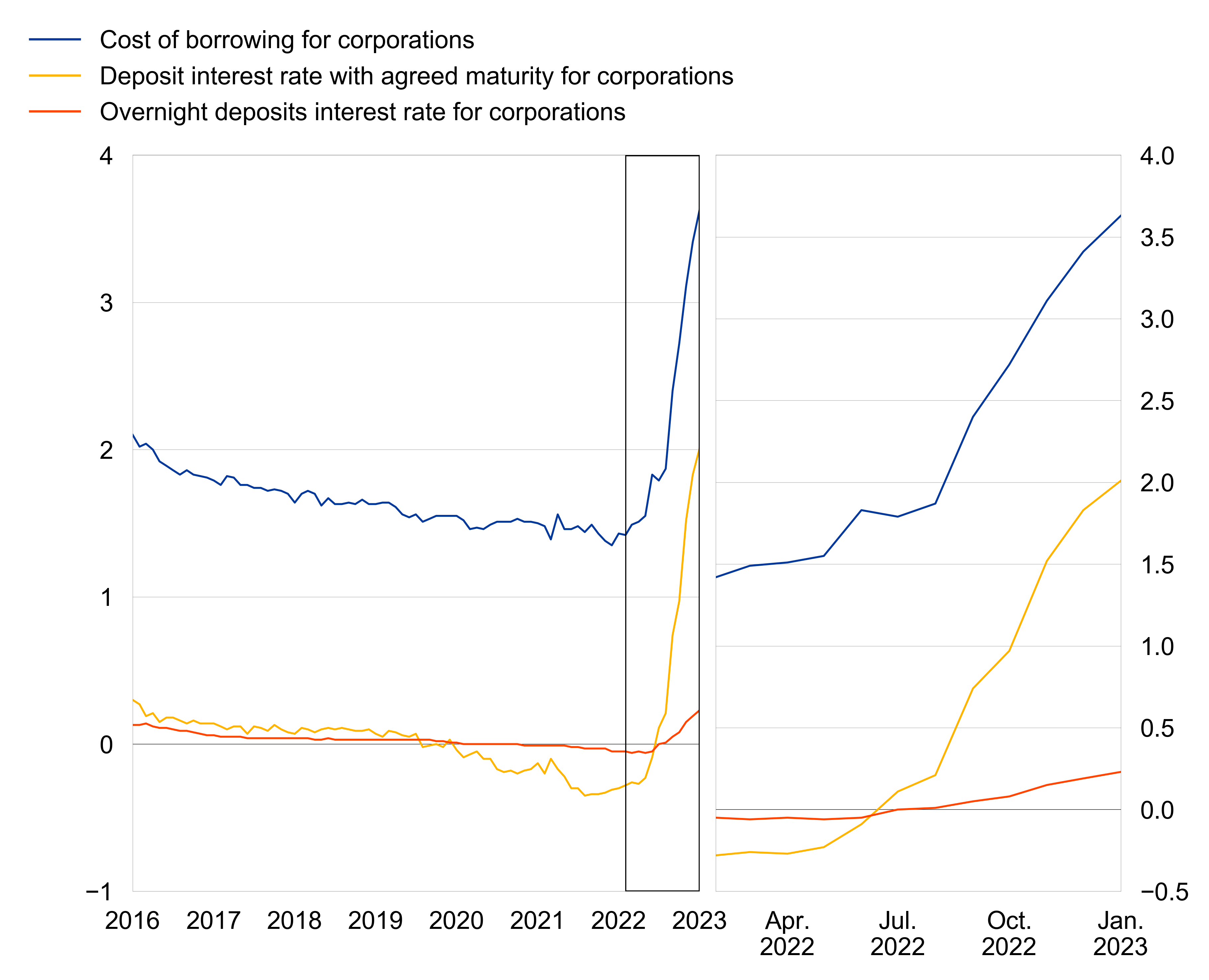

Euro area bank interest rate statistics: January 2023 - Source www.ecb.europa.eu

ECB Slashes Interest Rates To Stimulate Eurozone Economy

The European Central Bank (ECB) has slashed interest rates to stimulate economic growth in the Eurozone. The move comes as the Eurozone economy faces a number of challenges, including slowing growth, rising unemployment, and low inflation.

ECB Rates: Europe Joins Inflation Fight With First Increase in 11 Years - Source www.nytimes.com

The ECB's decision to cut interest rates is expected to have a number of positive effects on the Eurozone economy. Lower interest rates should make it cheaper for businesses to borrow money and invest, which could lead to increased economic activity. Lower interest rates should also make it cheaper for consumers to borrow money, which could lead to increased spending.

However, there are also some risks associated with the ECB's decision to cut interest rates. Lower interest rates could lead to higher inflation, which could erode the value of savings. Lower interest rates could also lead to a decline in the value of the euro, which could make it more expensive to import goods and services.

Overall, the ECB's decision to cut interest rates is a positive step that is likely to help stimulate economic growth in the Eurozone. However, it is important to be aware of the risks associated with this decision.

Table: Key Insights

| Key Insight | Explanation |

|---|---|

| Lower interest rates should make it cheaper for businesses to borrow money and invest, which could lead to increased economic activity. | When businesses can borrow money at lower interest rates, they are more likely to invest in new projects and expand their operations. This can lead to increased production, job creation, and economic growth. |

| Lower interest rates should also make it cheaper for consumers to borrow money, which could lead to increased spending. | When consumers can borrow money at lower interest rates, they are more likely to make purchases, such as buying a car or remodeling their home. This can lead to increased demand for goods and services, which can help boost economic growth. |

| Lower interest rates could lead to higher inflation, which could erode the value of savings. | When interest rates are low, there is more money in circulation. This can lead to higher prices for goods and services, which can erode the value of savings. |

| Lower interest rates could also lead to a decline in the value of the euro, which could make it more expensive to import goods and services. | When interest rates are low, the value of the euro is likely to decline. This is because investors are less likely to hold euros when they can get a higher return on their money by investing in other currencies. A weaker euro makes it more expensive to import goods and services, which can lead to higher prices for consumers. |

Conclusion

The ECB's decision to cut interest rates is a significant step that is likely to have a major impact on the Eurozone economy. It is important to be aware of both the potential benefits and risks of this decision so that you can make informed decisions about your own finances and investments.

The Eurozone economy is facing a number of challenges, but the ECB's decision to cut interest rates is a positive step that is likely to help stimulate growth. However, it is important to be aware of the risks associated with this decision and to monitor the situation closely.