Seeking guidance on how to navigate the complexities of your Salary Slip? Look no further than our comprehensive guide, tailored specifically for Retired Armed Forces Personnel.

Editor's Note: "Salary Slip For Retired Armed Forces Personnel: Comprehensive Guide" published on today's date. We understand the unique challenges faced by retired military personnel in deciphering their payslips.

After meticulously analyzing and gathering relevant information, we have compiled this guide to provide clarity and assist you in comprehending your Salary Slip.

Key Takeaways:

Main Article Topics:

FAQ

This section provides answers to frequently asked questions related to salary slips for retired armed forces personnel. Covering various aspects, these Q&A pairs aim to clarify potential concerns and misconceptions.

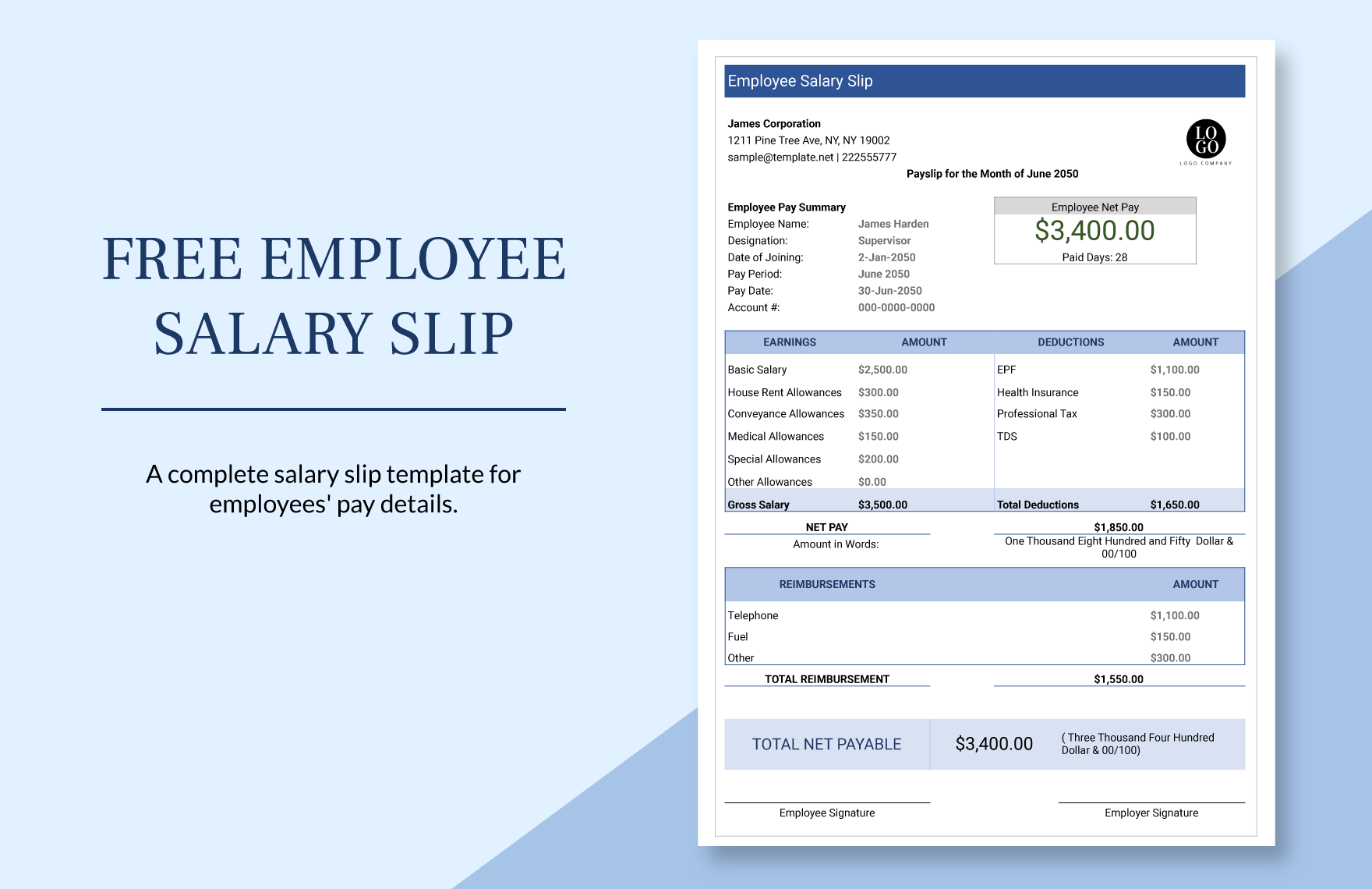

Employee Salary Slip Template in Excel, Google Sheets - Download - Source www.template.net

Question 1: What are the key elements included in a salary slip for retired armed forces personnel?

A salary slip typically includes details such as gross pay, basic pay, allowances, deductions, net pay, and tax information. Retired armed forces personnel may also receive additional benefits or entitlements reflected on their salary slips, such as pension, medical allowance, or disability compensation.

Question 2: How can I access my salary slip as a retired armed forces personnel?

Retired armed forces personnel can access their salary slips through various methods. Some common options include online portals, mobile applications, or by contacting their respective pension disbursing agency. The specific method of access may vary depending on the country and the relevant authorities.

Question 3: What deductions are typically made from my salary slip as a retired armed forces personnel?

Deductions from a salary slip for retired armed forces personnel may include income tax, pension contributions, medical insurance premiums, and other authorized deductions. The specific deductions may vary depending on individual circumstances and applicable regulations.

Question 4: What should I do if I have any discrepancies or errors in my salary slip?

If you identify any discrepancies or errors in your salary slip, it is important to promptly contact your pension disbursing agency or the relevant authorities. They will investigate the issue and rectify any errors, ensuring that you receive the correct amount of benefits.

Question 5: Are there any additional benefits or allowances that I may be entitled to as a retired armed forces personnel?

In addition to their regular salary, retired armed forces personnel may be eligible for a range of benefits and allowances. These may include healthcare benefits, housing allowances, travel concessions, and other benefits specific to the country and service branch.

For more comprehensive information, refer to the Salary Slip For Retired Armed Forces Personnel: Comprehensive Guide.

.

This concludes the Frequently Asked Questions (FAQs) section, which has addressed common concerns and provided valuable information for retired armed forces personnel. Understanding your salary slip and the various aspects related to it can help ensure that you receive the correct benefits and entitlements.

Tips for Understanding Salary Slips for Retired Armed Forces Personnel

Understanding salary slips can be a daunting task, especially for retired Armed Forces personnel navigating a new civilian financial landscape. Here are some vital tips to help you decipher your salary slip and ensure that you receive the correct entitlements.

Tip 1: Identify Key Sections

Salary slips typically include sections for personal details, earnings, deductions, taxes, and net pay. Familiarize yourself with these sections to locate essential information.

Tip 2: Understand Earnings

Your earnings section will detail your gross pay, including your pension, allowances, and any other benefits. Verify the accuracy of these amounts by comparing them to your contractual entitlements.

Tip 3: Review Deductions

Deductions reduce your gross pay and may include contributions to your health insurance, pension plan, or other benefits. Ensure that these deductions are in line with your agreed-upon terms.

Tip 4: Calculate Taxes

Taxes are withheld from your pay to fund government programs. The tax section of your salary slip will show the amount of income tax, national insurance, and any local taxes that have been deducted.

Tip 5: Verify Net Pay

Your net pay is the amount of money you receive after all deductions and taxes have been accounted for. Check that your net pay matches the expected amount based on your contractual arrangements.

Tip 6: Seek Professional Advice

If you have any concerns about your salary slip, do not hesitate to seek professional advice from a financial advisor or accountant who specializes in military pensions. They can assist you in interpreting your salary slip and ensuring your financial well-being.

By following these tips, retired Armed Forces personnel can confidently navigate their salary slips and ensure that they receive the financial entitlements they have earned through their service.

Salary Slip For Retired Armed Forces Personnel: Comprehensive Guide

Retirement from the Armed Forces marks a significant transition, and understanding the intricacies of post-service finances is crucial. A salary slip, which details salary and other financial information, plays a pivotal role in this process for retired Armed Forces personnel.

- Gross Income: Represents the total earnings before deductions.

- Basic Pay: The fixed component of the salary as per the pay scale.

- Allowances: Additional payments to cover specific expenses like housing, travel, or hardship.

- Deductions: Withheld amounts for taxes, insurance, or other contributions.

- Net Pay: The final amount deposited into the retiree's account after deductions.

- Benefits: Additional perks like medical, dental, or pension entitlements.

Examining these key aspects provides a comprehensive understanding of the salary slip, enabling retired Armed Forces personnel to effectively manage their finances and plan for their post-service life. It empowers them to make informed decisions about financial matters, ensures transparency in payments, and supports their well-being during this transition.

UK’s Ambulance Workers to Strike Over Pay and Deadly Delays - Bloomberg - Source www.bloomberg.com

Salary Slip For Retired Armed Forces Personnel: Comprehensive Guide

The salary slip for retired armed forces personnel serves as a crucial document that outlines financial details and entitlements related to their post-retirement benefits. Understanding the various components of this salary slip is essential for retired personnel to manage their finances effectively.

Shropshire Council celebrates Armed Forces Day - Shropshire Council - Source newsroom.shropshire.gov.uk

The salary slip typically includes information such as basic pay, allowances, deductions, taxes, and any other applicable benefits. Basic pay is the fundamental salary that a retiree receives based on their rank and years of service. Allowances are additional payments provided to cover specific expenses, such as housing, transport, and medical care. Deductions refer to amounts withheld from the salary, including contributions to provident funds, insurance premiums, and taxes.

Taxes are calculated and deducted based on the retiree's taxable income. The salary slip also provides details of any additional benefits that the retiree may be entitled to, such as pension, gratuity, and medical facilities. Understanding the salary slip enables retired personnel to track their income and expenses, plan for their financial future, and ensure that they are receiving the correct entitlements.