Are you aware of the “รายละเอียดและข้อมูลสิทธิประโยชน์สำหรับผู้เกษียณอายุราชการ”? Learn the details and understand the benefits that await you after retirement!

Editor's Notes: รายละเอียดและข้อมูลสิทธิประโยชน์สำหรับผู้เกษียณอายุราชการ has been published today, 07 March 2023. This is important information for those who are approaching retirement or are already retired. Understanding your benefits can help you plan for a secure and comfortable retirement.

We have done some analysis, digging information, made comparison and put together this รายละเอียดและข้อมูลสิทธิประโยชน์สำหรับผู้เกษียณอายุราชการ guide to help our target audience make the right decision.

FAQ

Refer to รายละเอียดและข้อมูลสิทธิประโยชน์สำหรับผู้เกษียณอายุราชการ for more details and information on employee termination benefits.

Question 1:

Tips

Retirement should be a time to enjoy the fruits of your labor, so it is important to make sure that you are financially secure. Here are a few tips to help you make the most of your retirement years:

Tip 1: Make a budget and stick to it. This will help you keep track of your income and expenses, and ensure that you are not spending more than you can afford.

Tip 2: Invest your money wisely. This is one of the most important things you can do to secure your financial future. There are many different investment options available, so it is important to do your research and find the ones that are right for you.

Tip 3: Take advantage of tax breaks. The government offers a number of tax breaks to retirees, so it is important to take advantage of them. This will help you save money on your taxes, and reduce your overall expenses.

Tip 4: Stay healthy. This will help you reduce your medical expenses and improve your overall quality of life. There are many things you can do to stay healthy, such as eating a healthy diet, exercising regularly, and getting enough sleep.

Tip 5: Enjoy your retirement. This is a time to do the things you have always wanted to do, so make the most of it. Travel, spend time with your family and friends, or volunteer for a cause you care about.

Retirement can be a great time of life, but it is important to be financially prepared. By following these tips, you can help ensure that you have a secure and enjoyable retirement.

Details and Benefit Information for Civil Servants upon Retirement

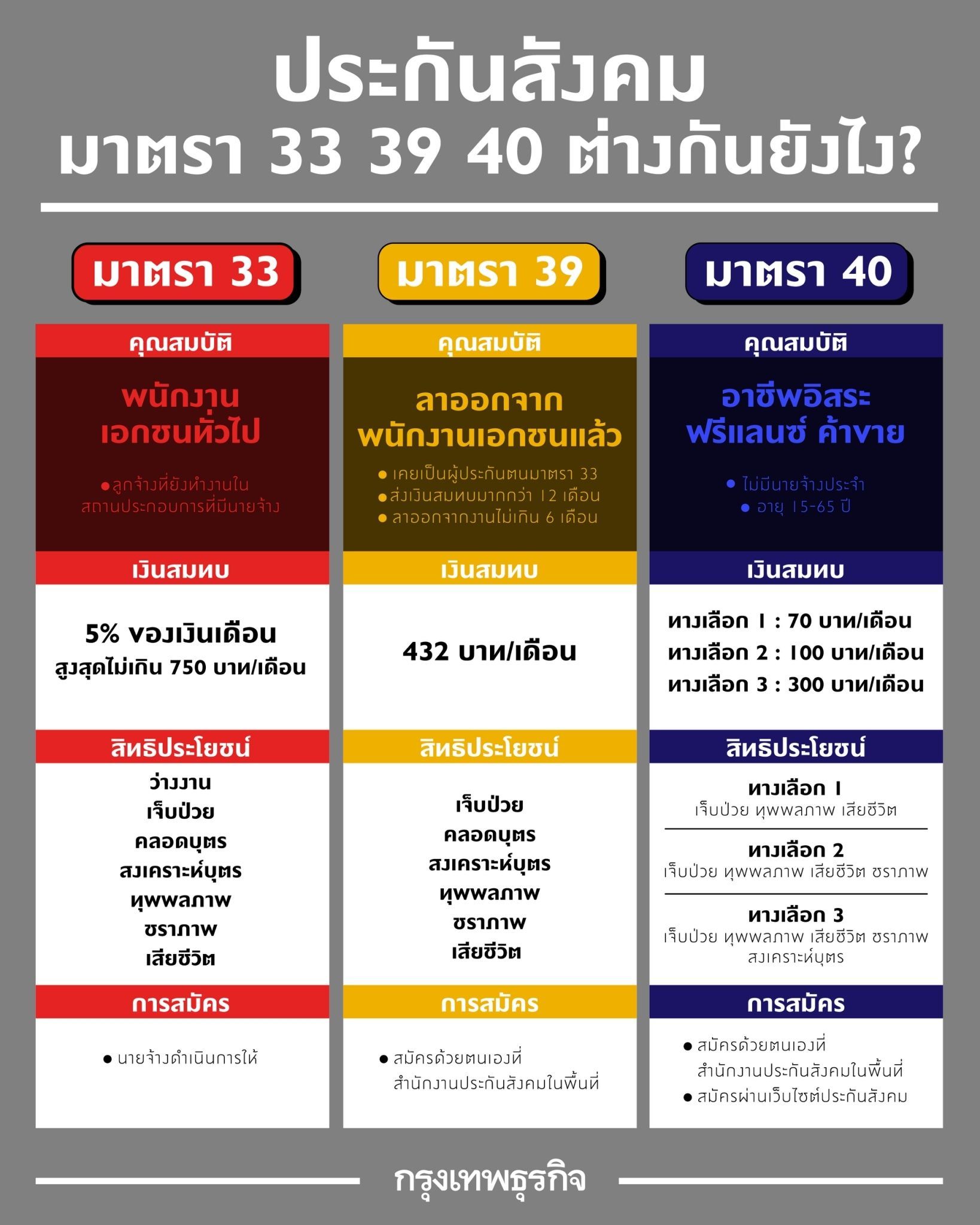

รู้จัก 'ประกันสังคม' ม.33 ม.39 ม.40 ต่างกันอย่างไร รัฐ 'เยียวยา' อะไรบ้าง? - Source www.bangkokbiznews.com

Understanding the details and benefits available for civil servants upon retirement is crucial for proper planning and financial security. Here are six key aspects to consider:

These benefits are designed to provide a degree of financial stability and security for civil servants during their retirement years. When combined, they can help ensure a comfortable and dignified life.

แจ้งหยุดเรียน 23 กันยายน 2565 - โรงเรียนหนองม่วงวิทยา อ.หนองม่วง จ.ลพบุรี - Source www.nmwit.ac.th

รายละเอียดและข้อมูลสิทธิประโยชน์สำหรับผู้เกษียณอายุราชการ

Understanding the details and benefits available to retirees is crucial for planning a secure and comfortable post-work life. These details and benefits directly impact retirees' financial stability, healthcare options, and overall well-being. By providing a comprehensive understanding of these aspects, retirees can make informed decisions that maximize their quality of life during their golden years.

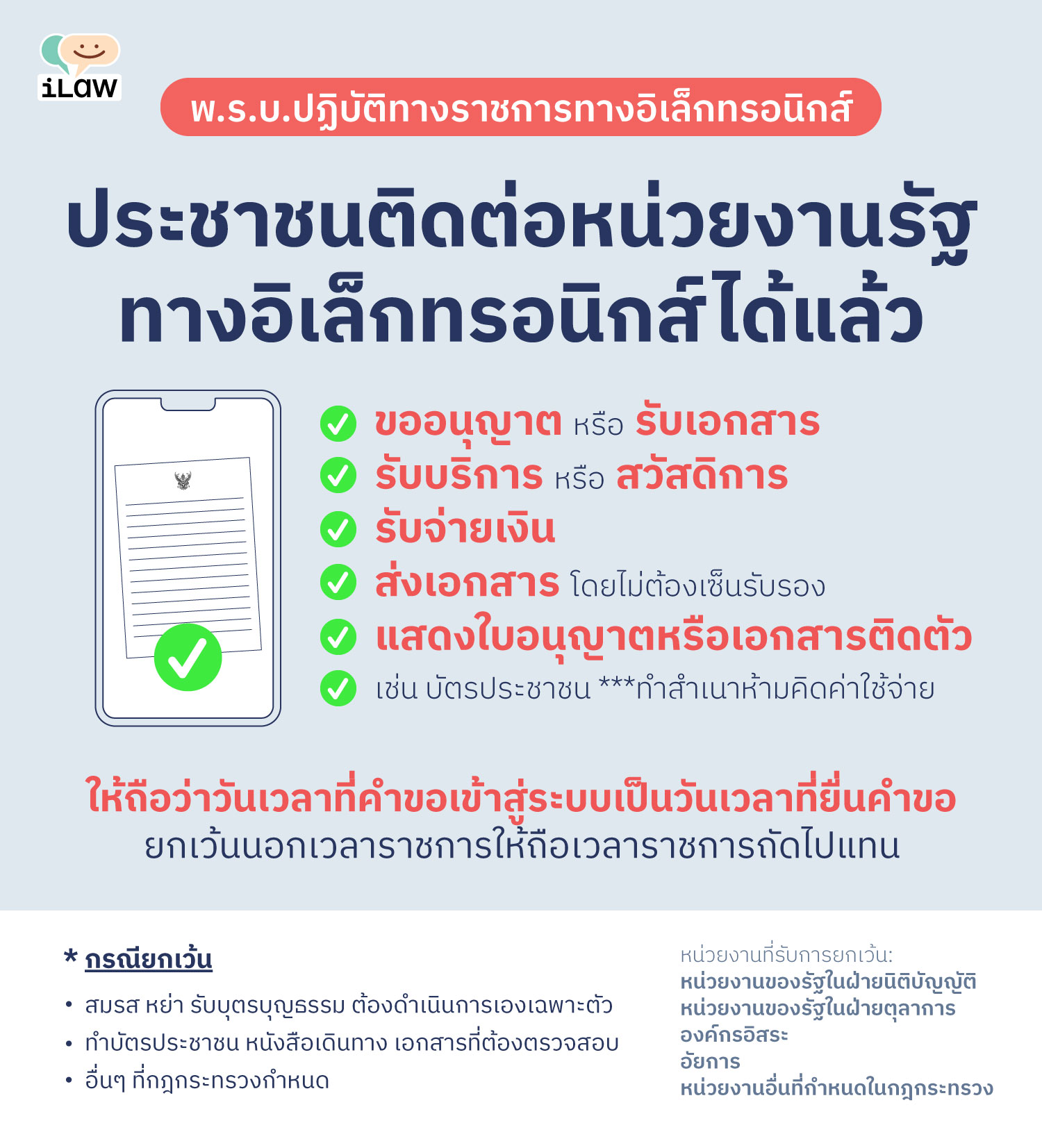

พ.ร.บ. ปฏิบัติทางราชการทางอิเล็กทรอนิกส์: ประชาชนติดต่อหน่วยงานรัฐทาง - Source www.ilaw.or.th

The details typically include information about pension plans, healthcare coverage, retirement savings accounts, and other financial benefits. Understanding the eligibility criteria, contribution limits, and investment options associated with these plans is essential for effective financial planning. Additionally, information on healthcare coverage, including Medicare, Medicaid, and private insurance options, is vital for ensuring access to quality healthcare services.

Recognizing the importance of these details and benefits, governments, employers, and financial institutions have a responsibility to provide clear and accessible information to retirees. This ensures that retirees are well-informed and empowered to make the best decisions for their future.

| Benefit | Description | |

|---|---|---|

| Pension Plans | Regular income payments after retirement | |

| Healthcare Coverage | Access to medical care services | |

| Retirement Savings Accounts | Tax-advantaged savings for retirement |

| Social Security Benefits | Federal income supplement for eligible retirees |

| Medicare | Government health insurance for seniors |

| Medicaid | Government health insurance for low-income individuals |

Conclusion

In conclusion, understanding the details and benefits available to retirees is paramount for ensuring a secure and fulfilling post-work life. By providing comprehensive information and support, governments, employers, and financial institutions empower retirees to make informed decisions that maximize their financial stability, healthcare options, and overall well-being. Recognizing the significance of this topic, ongoing efforts should focus on enhancing accessibility to these details and benefits, ensuring that all retirees can enjoy a dignified and comfortable retirement.

As society continues to evolve, the needs and expectations of retirees will also change. It is imperative that we remain adaptable and responsive to these changing needs, ensuring that retirees have access to the resources and support they deserve. By investing in the well-being of our retirees, we invest in a more secure and prosperous future for all.