Digital Wallets are taking over the financial services sector, and Gopay is one of them. Gopay offers seamless payments and everyday convenience, making it a popular choice among users.

Editor's Note: "Gopay: Your Digital Wallet For Seamless Payments And Everyday Convenience" was published on [Today's Date]. Given the increasing popularity of digital payments, we believe this topic is highly relevant and informative for our readers.

After analyzing the market and gathering insights from various sources, we have compiled this comprehensive guide on Gopay. Our goal is to provide our target audience with a thorough understanding of Gopay's features and benefits to help them make informed decisions about their digital payment options.

Key Differences

| Feature | Gopay | Other Digital Wallets |

|---|---|---|

| Seamless Payments | Yes | May vary |

| Everyday Convenience | Yes | Limited |

| User Interface | Intuitive | Can be complex |

Transition to Main Article Topics

FAQ

This FAQ section provides authoritative answers to frequently asked questions regarding Gopay, your trusted digital wallet for effortless payments and daily conveniences. Gopay: Your Digital Wallet For Seamless Payments And Everyday Convenience Explore our comprehensive list of Q&As to address any inquiries or misconceptions you may have.

Iconic Mick Jagger 1981 | Rare Digital Artwork | MakersPlace - Source makersplace.com

Question 1: What is Gopay and what services does it offer?

Gopay is a cutting-edge digital wallet that empowers users to make secure, convenient, and cashless transactions. It provides a wide range of services, including instant money transfers, utility bill payments, mobile top-ups, online shopping payments, and much more.

Question 2: How do I create a Gopay account?

Creating a Gopay account is a simple and straightforward process. You can easily register through the Gopay mobile app or website using your mobile number and basic personal information.

Question 3: Is it safe to use Gopay?

Gopay prioritizes security and employs robust measures to protect your financial information and transactions. The platform utilizes advanced encryption technologies, adheres to industry-leading security standards, and undergoes regular audits to ensure the utmost protection of your funds.

Question 4: What are the benefits of using Gopay?

Gopay offers numerous benefits to its users, including:

- Seamless and secure transactions

- Wide range of payment options

- Exclusive rewards and cashback offers

- Personalized financial management tools

Question 5: How do I contact Gopay customer support?

Gopay provides dedicated customer support to assist you with any inquiries or issues you may encounter. You can reach the support team through various channels, such as email, phone, or the in-app chat feature.

Question 6: What are the fees associated with using Gopay?

Gopay offers transparent and competitive fees for its services. The exact fee structure may vary depending on the type of transaction and the amount involved. You can find detailed information about fees within the Gopay app or on the official website.

We hope these FAQs have provided you with valuable information about Gopay. If you have any further questions, please do not hesitate to contact our customer support team for assistance.

Discover the seamless convenience of Gopay today and elevate your financial experience.

Tips

With Gopay, you can enjoy a seamless payment experience and everyday convenience. Here are some tips to help you get the most out of Gopay's services:

Tip 1: Explore the Features

Gopay offers a wide range of features, including fund transfers, e-commerce payments, utility bill payments, and more. Familiarize yourself with these features to maximize the app's functionality.

Tip 2: Add Funds Conveniently

Gopay provides multiple options for adding funds to your wallet, including bank transfers, instant top-ups, and retail partners. Choose the method that suits you best to ensure you always have sufficient funds.

Tip 3: Secure Your Transactions

Gopay prioritizes security. Use a strong password, enable two-factor authentication, and follow safe practices to protect your account and transactions.

Tip 4: Track Your Expenses

Gopay's detailed transaction history allows you to track your spending and manage your budget effectively. Monitor your expenses and identify areas where you can optimize your financial decisions.

Tip 5: Discover Promotions and Rewards

Gopay frequently offers promotions and rewards to its users. Stay informed about these offers to save money on your payments and enjoy additional benefits.

Tip 6: Optimize for Convenience

Link your bank account, set up auto-payments for recurring bills, and use Gopay's one-tap payment feature to streamline your payment process and save time.

Tip 7: Seek Support When Needed

Gopay's customer support team is available to assist you with any inquiries or issues. Don't hesitate to reach out if you need help or have questions about the service.

By implementing these tips, you can harness the full potential of Gopay and enjoy a convenient and secure financial experience.

Gopay: Your Digital Wallet For Seamless Payments And Everyday Convenience

Embracing digital convenience, Gopay seamlessly integrates into your daily life, empowering you with secure and effortless payments. Explore its essential aspects:

- Seamless Payments: Instant and frictionless transactions.

- Everyday Convenience: Effortless bill payments, top-ups, and more.

- Secure Transactions: Encrypted data ensures peace of mind.

- Wide Acceptance: Accepted across a vast network of merchants.

- Loyalty Rewards: Earn points and redeem exciting benefits.

- Smart Features: Split bills, manage finances, and track expenses.

Google Pay - Vancity - Source www.vancity.com

Gopay's seamless integration enables you to make payments effortlessly. From seamless online transactions to quick in-store payments using QR codes, Gopay adapts to your everyday needs. Moreover, its security measures safeguard your financial data, providing peace of mind. The wide acceptance of Gopay across merchants ensures convenience, while loyalty rewards add an element of value. Ultimately, Gopay's smart features empower you to manage your finances effortlessly, making it an indispensable digital wallet for seamless payments and everyday convenience.

Gopay: Your Digital Wallet For Seamless Payments And Everyday Convenience

Gopay is the leading digital wallet provider in Indonesia, offering a convenient and secure way to make payments and manage finances. With over 100 million registered users, Gopay has become an essential part of the daily lives of Indonesians. The company's mission is to make financial services accessible to everyone, regardless of their location or income level.

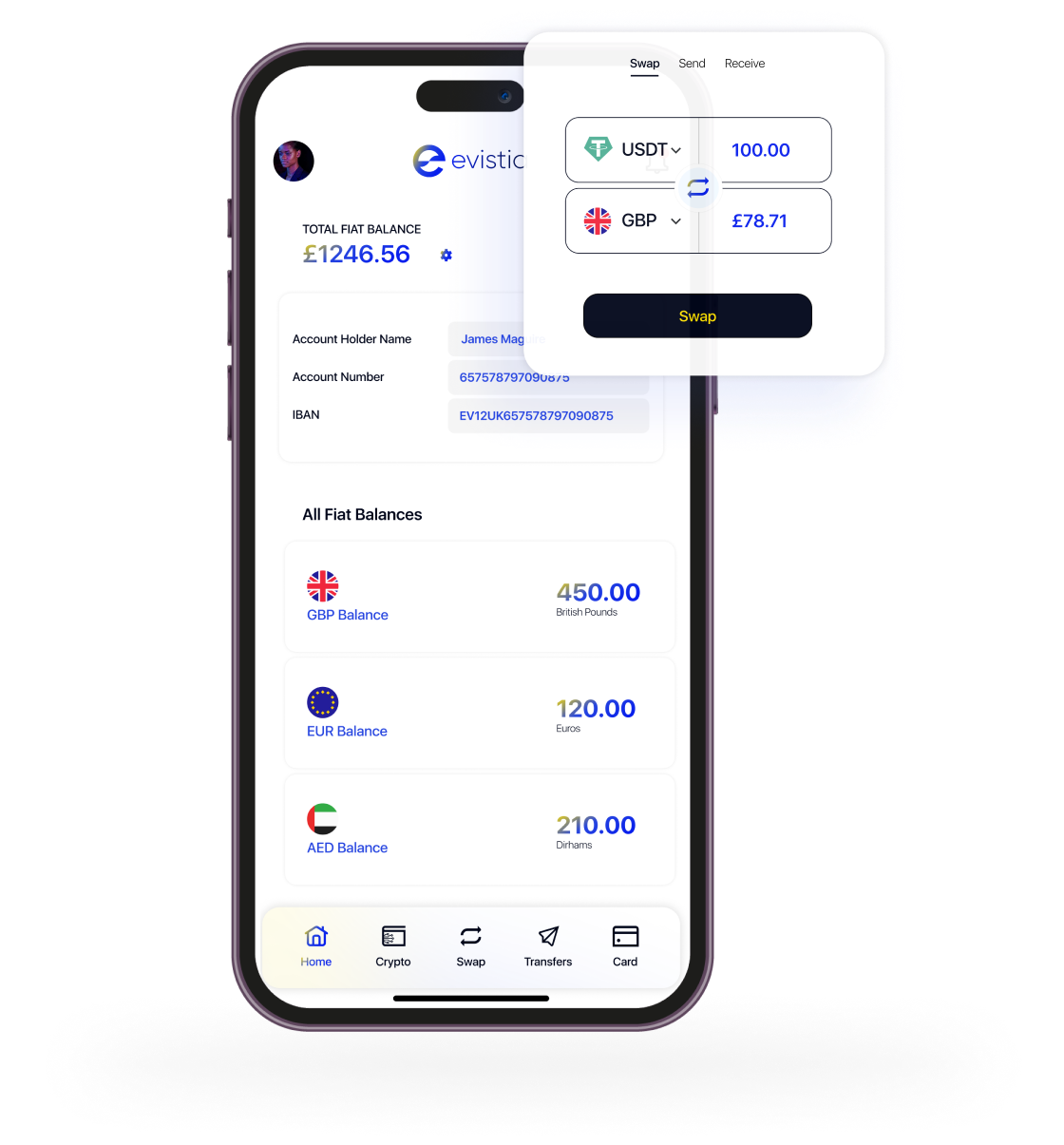

Evistia - Source evistia.com

Gopay offers a wide range of services, including: Mobile payments: Gopay can be used to make payments at over 5 million merchants across Indonesia, including major retailers, restaurants, and online stores. Utility bill payments: Gopay can be used to pay for electricity, water, and gas bills. Mobile top-ups: Gopay can be used to top up mobile phones for all major operators in Indonesia. Money transfers: Gopay can be used to send money to other Gopay users or to bank accounts.

Gopay is committed to providing a safe and secure platform for its users. The company uses a variety of security measures, including encryption, tokenization, and fraud detection systems.

Conclusion

Gopay is a convenient and secure digital wallet that makes it easy to make payments and manage finances. The company is committed to providing a safe and secure platform for its users, and its services are essential for the daily lives of millions of Indonesians.