When was the last time you looked at the dollar exchange rate? If you're like most people, you probably don't think about it very often. But if you're planning on traveling internationally, or if you're a business owner who imports or exports goods, then you need to be aware of the dollar exchange rate. That's why we've put together this comprehensive guide to today's dollar exchange rate.

Editor's Note: "Today's Dollar Exchange Rate: Comprehensive Guide And Analysis" have published on [Today Date]

We'll cover everything you need to know about the dollar exchange rate, including what it is, how it's determined, and how it can affect your travel plans or business. We'll also provide you with some tips on how to get the best possible exchange rate.

3d Illustration The dollar exchange rate is rising 23364745 PNG - Source www.vecteezy.com

| Feature | Today's Dollar Exchange Rate | Other Exchange Rate Sources |

|---|---|---|

| Comprehensiveness | Covers all major currencies and provides historical data | May not cover all currencies or provide historical data |

| Accuracy | Sourced from reliable financial institutions | Accuracy may vary depending on the source |

| Ease of Use | User-friendly interface and clear explanations | Interface may be complex or difficult to understand |

- The dollar exchange rate is the value of the US dollar compared to other currencies.

- The dollar exchange rate is determined by a number of factors, including supply and demand, interest rates, and economic conditions.

- The dollar exchange rate can have a significant impact on travel plans and business operations.

- There are a number of things you can do to get the best possible exchange rate.

- What is the Dollar Exchange Rate?

- How is the Dollar Exchange Rate Determined?

- How Can the Dollar Exchange Rate Affect Me?

- How Can I Get the Best Possible Exchange Rate?

FAQ

Should you need to be informed on today’s dollar exchange rate, Today's Dollar Exchange Rate: Comprehensive Guide And Analysis provides a thorough examination and study of its numerous facets, making it a valuable resource.

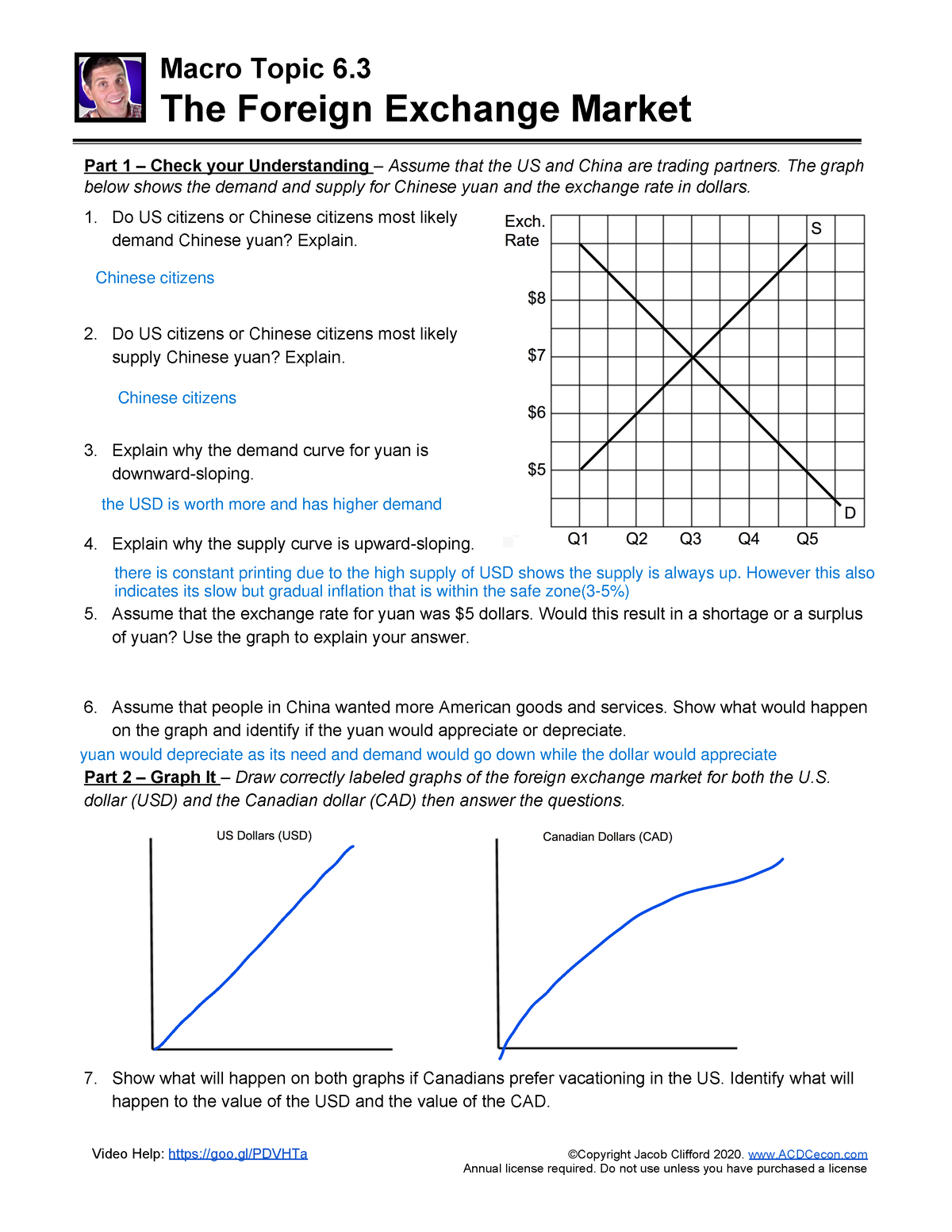

Macro Topic 6 - The Foreign Exchange Market Part 1 – Check your - Source www.studocu.com

Question 1: What exactly is meant by "dollar exchange rate"?

Answer: The dollar exchange rate is the value of the US dollar relative to other currencies.

Question 2: What are the factors that influence the dollar exchange rate?

Answer: A number of factors influence the dollar exchange rate, including economic growth, interest rates, inflation, and political stability.

Question 3: How can I find out the current dollar exchange rate?

Answer: You can find the current dollar exchange rate on websites such as XE or OANDA.

Question 4: What are the implications of a strong or weak dollar?

Answer: A strong dollar can make it more expensive for US businesses to export goods, while a weak dollar can make it cheaper for US businesses to export goods.

Question 5: How does the dollar exchange rate affect the economy?

Answer: The dollar exchange rate can have a significant impact on the economy, as it can affect the cost of goods, the value of investments, and the overall level of economic growth.

Question 6: What are some tips for managing the impact of the dollar exchange rate?

Answer: There are a number of strategies that businesses and investors can use to manage the impact of the dollar exchange rate, such as hedging and diversification.

The dollar exchange rate is a complex and ever-changing topic. By understanding the basics of the dollar exchange rate, you can make informed decisions about how to manage its impact on your business or investments.

Explore the article in detail to further your understanding of the multifaceted impacts of today’s dollar exchange rate.

Tips

This comprehensive guide provides valuable tips to enhance understanding and decision-making regarding currency exchange rates.

Tip 1: Monitor Currency Trends and Patterns

Regularly track currency fluctuations and identify historical patterns. Use reliable sources such as financial news outlets, currency monitoring platforms, and economic data to stay informed about factors influencing exchange rates.

Tip 2: Compare Exchange Rates from Multiple Sources

Avoid relying solely on a single source for exchange rates. Compare rates from different banks, currency exchange services, and online platforms to secure the most favorable deal.

Tip 3: Consider Additional Fees and Charges

In addition to the exchange rate, factor in any additional fees or charges associated with the transaction. These may include transfer fees, wire fees, or exchange commissions.

Tip 4: Opt for Market Orders for Immediate Execution

If timely execution is crucial, choose market orders. These orders are executed at the current market rate, providing immediate access to the exchanged currency.

Tip 5: Utilize Currency Contracts to Manage Risk

Consider using currency contracts such as forwards or options to lock in exchange rates and protect against future fluctuations. These contracts provide flexibility and risk management options.

Key Takeaways:

- Staying informed about currency trends and patterns enhances decision-making.

- Comparing exchange rates from multiple sources ensures the most favorable deal.

- Considering additional fees and charges allows for accurate cost assessment.

- Utilizing currency contracts provides risk management and flexibility.

By incorporating these tips, individuals can make informed decisions regarding currency exchange rates, maximizing their understanding and optimizing their financial strategies.

Today's Dollar Exchange Rate: Comprehensive Guide And Analysis

Comprehending the nuances of today's dollar exchange rate necessitates delving into crucial aspects that shape its value and impact global financial markets.

- Economic Indicators: GDP growth, inflation, interest rates influence the demand for dollars.

- Political Stability: Currency stability depends on political stability, impacting investor confidence.

- Monetary Policy: Central banks' decisions regarding interest rates and quantitative easing affect the dollar's value.

- Global Trade: International trade patterns impact demand for dollars, influencing its exchange rate.

- Sentiment & Speculation: Investor sentiment and speculative trading can lead to short-term exchange rate fluctuations.

- Supply & Demand: The availability of dollars in the foreign exchange market plays a vital role in determining the exchange rate.

Understanding these aspects provides a comprehensive understanding of the factors that drive today's dollar exchange rate. Moreover, real-time analysis tools and expert insights can help investors navigate the dynamic foreign exchange market and make informed decisions.

RMB Exchange Rate And Trade Balance ScienceDirect, 57% OFF - Source gbu-hamovniki.ru

Today's Dollar Exchange Rate: Comprehensive Guide And Analysis

Today's exchange rate is a crucial factor in international trade, tourism, and investment decisions. Understanding the forces that determine the value of the dollar can help businesses and individuals make informed decisions about their financial transactions. This guide provides a comprehensive analysis of today's dollar exchange rate, exploring the factors that influence its value, its impact on global markets, and strategies for managing currency risk.

Visiting Nigeria For The First Time? Here’s Your Tech Guide - Dignited - Source www.dignited.com

The value of the dollar is influenced by a complex interplay of factors, including economic growth, interest rates, inflation, and political stability. Strong economic growth and low inflation tend to strengthen the dollar, making it more valuable relative to other currencies. Higher interest rates in the United States also make the dollar more attractive to investors, as they can earn a higher return on their investments. Political stability and a positive economic outlook also contribute to a stronger dollar.

The dollar exchange rate has a significant impact on global markets. A strong dollar makes it more expensive for U.S. companies to export goods and services, which can lead to a decline in exports. However, a strong dollar also makes it cheaper for U.S. businesses to import goods and services, which can lead to lower prices for consumers. Similarly, a weak dollar can boost exports but lead to higher import costs.

Businesses and individuals can manage currency risk by using hedging strategies, such as forward contracts or options. These instruments allow them to lock in an exchange rate today for a future transaction, protecting them from adverse movements in the exchange rate.

Understanding the factors that influence the dollar exchange rate is essential for making informed decisions about international financial transactions. By considering the economic, political, and market forces at play, businesses and individuals can mitigate currency risk and maximize their financial returns.

Conclusion

This guide has provided a comprehensive analysis of today's dollar exchange rate, exploring the factors that influence its value, its impact on global markets, and strategies for managing currency risk. Understanding the forces that drive the dollar's value is essential for businesses and individuals to make informed decisions about their financial transactions. By considering the economic, political, and market factors at play, they can mitigate currency risk and maximize their financial returns.

The dollar exchange rate is a dynamic and ever-changing force in global markets. Staying informed about the latest developments and trends in the foreign exchange market is crucial for staying ahead of the curve and making sound financial decisions.