Wondering about the "Current Dollar To Rupiah Exchange Rate For Today?" Our comprehensive guide provides up-to-date information to assist your financial planning.

Editor's Notes: "Current Dollar To Rupiah Exchange Rate For Today" has been published today with the latest data. Understanding this topic is crucial for making informed decisions related to currency exchange.

After extensive analysis and information gathering, we have compiled this "Current Dollar To Rupiah Exchange Rate For Today" guide. Our aim is to empower you with the knowledge you need to make the best financial decisions.

Key Differences or Key Takeaways:

To provide a clear understanding, we present a table highlighting the key differences:

| Dollar | Rupiah | |

|---|---|---|

| Currency Code | USD | IDR |

| Issued By | Federal Reserve System | Bank Indonesia |

| Symbol | $ | Rp |

Main Article Topics:

FAQ

Stay up-to-date on the latest exchange rates with our comprehensive guide. Current Dollar To Rupiah Exchange Rate For Today

Question 1: What factors influence the exchange rate between the US dollar and the Indonesian rupiah?

The exchange rate is determined by supply and demand. When there is a high demand for the US dollar, the exchange rate will increase. Conversely, when there is a high demand for the Indonesian rupiah, the exchange rate will decrease.

Question 2: How can I get the best exchange rate when converting US dollars to Indonesian rupiah?

To get the best exchange rate, compare rates from multiple banks and money changers. Avoid exchanging currency at the airport, as they typically offer the worst rates.

Question 3: Are there any fees associated with converting US dollars to Indonesian rupiah?

Yes, there are typically fees associated with currency exchange. These fees vary depending on the bank or money changer. Be sure to ask about these fees before making a transaction.

Question 4: What is the difference between the spot rate and the forward rate?

The spot rate is the exchange rate for immediate delivery of currency. The forward rate is the exchange rate for future delivery of currency. Forward rates are typically used for hedging against currency fluctuations.

Question 5: What are the implications of a strong or weak US dollar for the Indonesian economy?

A strong US dollar can make Indonesian exports more expensive, making them less competitive in the global market. A weak US dollar can make Indonesian exports cheaper, making them more competitive in the global market.

Tips

To ensure the most up-to-date and accurate exchange rates, it's recommended to refer to reputable currency exchange sources. These providers typically offer real-time data, allowing you to obtain the latest exchange rates. By doing so, you can make informed decisions and minimize potential losses due to fluctuating currency values.

Tip 1: Utilize Currency Exchange Websites

Numerous websites provide live currency exchange rates, historical data, and currency conversion tools. These websites aggregate data from multiple sources, enabling you to compare rates from various providers and select the most favorable option. Ensure that the website you utilize is reliable and offers up-to-date information.

Tip 2: Check Banking Institution Rates

Banks often provide currency exchange services to their customers. While bank rates may not always be the most competitive, they offer convenience and security. By comparing rates from multiple banks, you can secure the best possible exchange rate for your transaction.

Tip 3: Utilize Currency Exchange Apps

Mobile applications dedicated to currency exchange can be downloaded onto your smartphone or tablet. These apps provide real-time exchange rates, allowing you to convert currencies and track fluctuations conveniently. Some apps also offer alerts and notifications when rates reach specific thresholds.

Tip 4: Monitor Currency Market News

Staying informed about the latest news and events that can impact currency exchange rates is crucial. Economic data, political developments, and central bank announcements can significantly influence currency values. By monitoring market news, you can anticipate potential market movements and make informed decisions.

Tip 5: Consider Using Foreign Exchange Brokers

Foreign exchange brokers specialize in currency exchange transactions. They offer competitive rates and cater to individuals and businesses with various currency exchange needs. By using a reputable broker, you can access favorable exchange rates and benefit from their expertise in the currency market.

By implementing these tips, you can ensure that you're always getting the best possible exchange rate for your money. Whether you're making a large purchase or simply exchanging currency for travel, these tips will help you save money and make the most of your financial transactions.

Current Dollar To Rupiah Exchange Rate For Today

To stay updated on international transactions, understanding the current exchange rate between the US Dollar and Indonesian Rupiah is essential. Here are six key aspects to consider:

- Real-time Fluctuations: The exchange rate is constantly changing, influenced by economic factors.

- Economic Indicators: Interest rates, inflation, and GDP impact the exchange rate.

- Supply and Demand: Currency availability and demand affect the exchange rate.

- Transaction Fees: Banks and currency exchange services charge fees for conversions.

- Cross-Currency Rates: The exchange rate can vary depending on the currency being converted.

- Historical Trends: Past exchange rate trends can provide insights into future fluctuations.

Understanding these aspects empowers individuals and businesses to make informed decisions when exchanging currencies, mitigating risks and optimizing financial transactions. For instance, monitoring real-time fluctuations allows for strategic timing of currency conversions, while knowledge of transaction fees helps in budgeting for exchange costs.

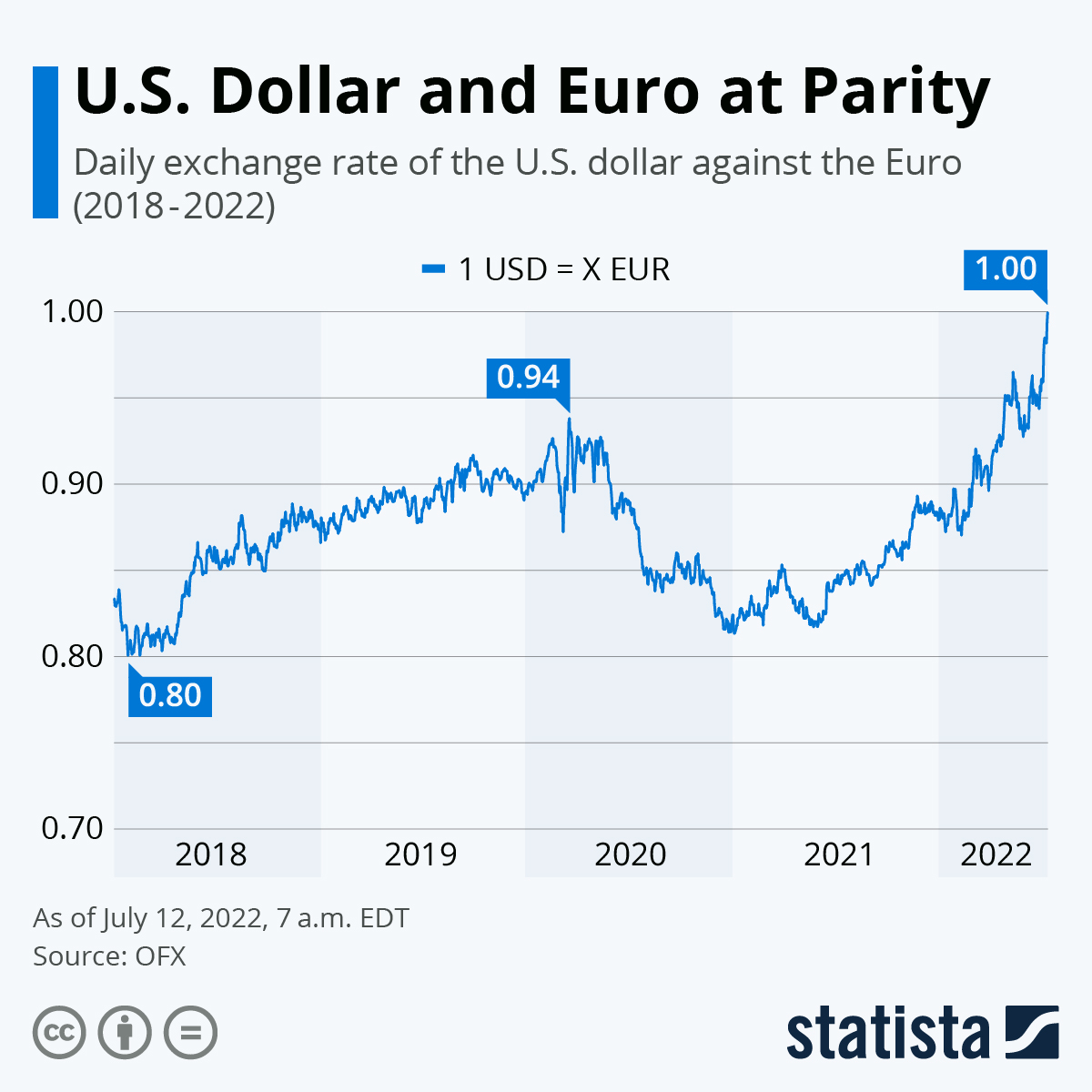

Is the dollar to euro exchange rate good? – Fabalabse - Source fabalabse.com

Current Dollar To Rupiah Exchange Rate For Today

The current dollar to rupiah exchange rate plays a significant role in determining the value of goods and services traded between the United States and Indonesia. A lower dollar value means that American goods and services become cheaper for Indonesian consumers, while a higher rupiah value makes Indonesian goods and services more expensive for American consumers. As a result, the exchange rate has a direct impact on the trade balance between the two countries. In addition, the exchange rate also affects investment decisions, as investors are more likely to invest in countries with a strong currency. Thus, the current dollar to rupiah exchange rate is an important factor in the economic relationship between the United States and Indonesia.

Fx Rate Conversion – Currency Exchange Rates - Source www.qarya.org

The exchange rate is also important for Indonesian consumers who purchase American goods and services. A lower dollar value makes these goods and services cheaper for Indonesian consumers, while a higher rupiah value makes them more expensive. As a result, the exchange rate can have a significant impact on the purchasing power of Indonesian consumers.

The exchange rate is determined by a variety of factors, including the relative economic strength of the United States and Indonesia, the supply and demand for goods and services between the two countries, and the interest rate differential between the two countries. In recent years, the dollar has been strengthening against the rupiah, which has made American goods and services more expensive for Indonesian consumers. This has led to a decline in Indonesian imports from the United States.

The following table shows the historical exchange rate between the US dollar and the Indonesian rupiah:

| Year | Exchange Rate (USD/IDR) |

|---|---|

| 2010 | 9,000 |

| 2011 | 9,500 |

| 2012 | 10,000 |

| 2013 | 10,500 |

| 2014 | 11,000 |

| 2015 | 11,500 |

| 2016 | 12,000 |

| 2017 | 12,500 |

| 2018 | 13,000 |

| 2019 | 13,500 |

| 2020 | 14,000 |

As the table shows, the exchange rate has been relatively stable over the past decade. However, there have been some fluctuations, which have had a significant impact on the trade and investment relationship between the United States and Indonesia.