Do you know about "Claim A Tax Refund: Comprehensive Guide To HM Revenue and Customs (HMRC)" ?

Editor's Notes: "Claim A Tax Refund: Comprehensive Guide To HM Revenue And Customs (HMRC)" have published on today date. Knowing this information is much important as it can help you get your money back.

We have analyzed, digged information, made research and put together this "Claim A Tax Refund: Comprehensive Guide To HM Revenue And Customs (HMRC)" guide to help you make the right decision.

Here are the key differences between "Claim A Tax Refund: Comprehensive Guide To HM Revenue And Customs (HMRC)":

FAQ

This section provides answers to frequently asked questions (FAQs) about claiming a tax refund from HM Revenue and Customs (HMRC). Claim A Tax Refund: Comprehensive Guide To HM Revenue And Customs (HMRC) by addressing common concerns and misconceptions.

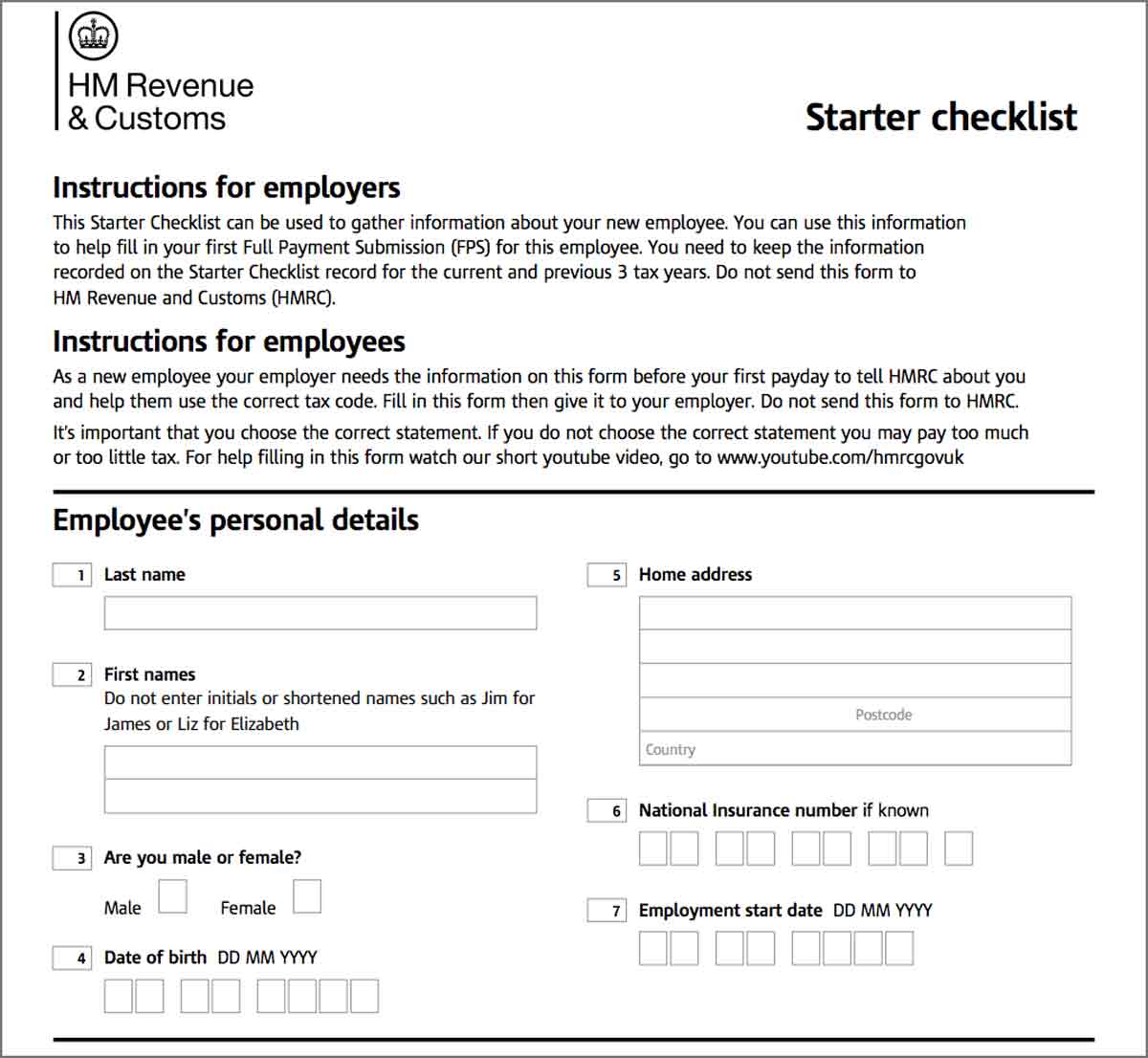

HMRC Starter Checklist Explained | Guide & FAQ For Employers - Source www.creative.onl

Question 1: Who is eligible to claim a tax refund?

Question 2: What is the time limit for claiming a tax refund?

Question 3: How do I claim a tax refund?

Question 4: What documents do I need to provide with my claim?

Question 5: How long does it take to receive a tax refund?

Question 6: What should I do if my claim is rejected?

Understanding the eligibility criteria, time limits, and procedures for claiming a tax refund is crucial to avoid any potential delays or complications. By addressing common FAQs, individuals can navigate the process smoothly and maximize their chances of receiving a successful refund.

For more comprehensive information, refer to the resource on Claim A Tax Refund: Comprehensive Guide To HM Revenue And Customs (HMRC).

Tips

Understanding the process for claiming a tax refund can be perplexing. HM Revenue and Customs (HMRC) has established comprehensive guidelines to assist. By following these tips, individuals can navigate the process efficiently and maximize their refund entitlements.

Tip 1: Check Eligibility

Prior to initiating a claim, it is crucial to determine eligibility. Only individuals who have overpaid taxes during a specific tax year can claim a refund. HMRC advises reviewing tax records to ascertain any discrepancies or overpayments.

Tip 2: Gather Necessary Documents

To process a refund claim, HMRC requires supporting documentation. This may include payslips, bank statements, or official letters from relevant organizations demonstrating overpaid taxes.

Tip 3: Use HMRC's Online Services

HMRC offers convenient online platforms for submitting refund claims. These digital tools provide step-by-step guidance, ensuring accuracy and expediting the claim process.

Tip 4: Claim Within the Timeframe

Claiming within the specified time frame is essential to avoid missing out on eligible refunds. Typically, individuals have four years from the end of the tax year to submit a claim.

Tip 5: Be Patient

Processing refund claims can take time. HMRC advises patience and encourages individuals to track the status of their claim online or via phone inquiries.

By adhering to these tips, individuals can confidently claim their tax refunds. HMRC's resources and online services simplify the process, enabling taxpayers to recover overpaid taxes efficiently.

Claim A Tax Refund: Comprehensive Guide To HM Revenue And Customs (HMRC)

Filing for a tax refund can be a daunting task, especially with the complexities of the HM Revenue and Customs (HMRC) system. This comprehensive guide will break down the essential aspects of claiming a tax refund from HMRC, providing a clear roadmap for individuals seeking to recover overpaid taxes.

- Eligibility Criteria: Understand the qualifying conditions for claiming a tax refund.

- Filing Process: Learn about the steps involved in submitting a tax refund claim to HMRC.

- Documentation Required: Identify the necessary documents to support your refund claim.

- Time Limits: Be aware of the deadlines for filing a tax refund.

- Claim Calculation: Calculate the amount of tax you are entitled to reclaim.

- Dispute Resolution: Explore options for resolving disputes with HMRC regarding tax refunds.

The Consequences of Late or Avoided Capital Gains Tax Payments: A - Source cgt-help.co.uk

Understanding these key aspects will empower individuals to navigate the HMRC tax refund process effectively, ensuring a seamless and successful claim. For instance, knowing the eligibility criteria helps determine if a refund is due, while understanding the filing process guides claimants through the correct submission channels. Furthermore, being aware of the time limits ensures timely filing and prevents potential penalties. By addressing these aspects in detail, this guide provides a comprehensive resource for maximizing tax refund claims from HMRC.

Claim A Tax Refund: Comprehensive Guide To HM Revenue And Customs (HMRC)

Claims for tax refunds can be made through HM Revenue and Customs (HMRC), the UK's tax authority. Taxpayers may be eligible for a refund if they have overpaid their taxes, for example, if they have paid too much income tax or national insurance contributions. To claim a refund, taxpayers can use HMRC's online service or fill out a paper form. They will need to provide their personal and financial information, as well as details of the overpayment. HMRC will then process the claim and issue a refund if it is valid.

Self-Employed - TaxDash - Source taxdash.co.uk

Taxpayers should be aware that there are time limits for claiming a tax refund. For most types of tax, the claim must be made within four years of the end of the tax year in which the overpayment occurred.

Claiming a tax refund can be a straightforward process, but it is important to ensure that the claim is made correctly and within the time limits. Taxpayers who are unsure whether they are eligible for a refund or who need help making a claim can contact HMRC for assistance.

Conclusion

Claiming a tax refund can be a valuable way to recover money that has been overpaid to HMRC. Taxpayers who believe they may be eligible for a refund should make a claim as soon as possible to avoid missing out.

HMRC has a range of resources available to help taxpayers claim a refund, including an online service and paper forms. Taxpayers can also contact HMRC for assistance if they need help making a claim.